Der internationale Kupferpreis in 2024 weist einen schwankenden Aufwärtstrend auf, getrieben durch mehrere Faktoren, einschließlich der Erholung der Weltwirtschaft, die Nachfrage nach einer grünen Energiewende, supply chain constraints in copper mining, and financial market sentiments. This article will analyze the performance of copper prices in 2024 with specific data and key driving factors, provide a reasonable forecast for copper price trends in 2025, and offer operational recommendations to industry professionals.

Overview of International Copper Prices in 2024 and Key Influencing Factors

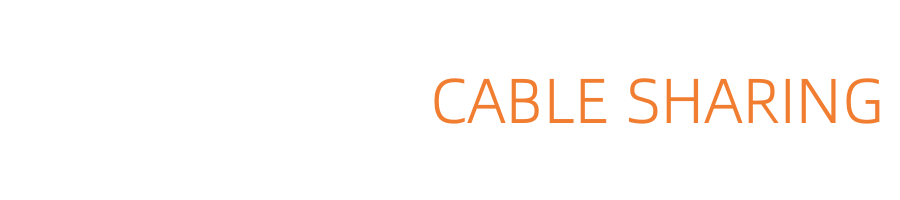

In 2024, copper prices primarily fluctuated between $9,000 und $10,500 per ton. Below is a summary of copper price performance by quarter:

First Quarter: At the beginning of 2024, copper prices ranged from approximately $9,000 zu $9,500, reflecting a slow global economic recovery and moderate demand.

Second Quarter: From April to June, copper prices rose further to between $9,500 und $9,800, driven by a rebound in manufacturing and green energy demand.

Third Quarter: In August, copper prices surpassed $10,000, with prices nearing $10,500 by September, mainly due to increased demand for renewable energy and ongoing supply chain bottlenecks.

Fourth Quarter Forecast: It is anticipated that copper prices will fluctuate between $9,500 und $10,500 in the fourth quarter. As seasonal demand weakens towards the end of the year, a slight pullback may occur.

Key Data Summary:

Major Influencing Factors on International Copper Prices in 2024

Green Energy Transition and Electric Vehicle Demand

Global Green Energy Transition: In 2024, countries worldwide are increasing investments in wind energy, solar power, and grid upgrades, resulting in strong copper demand. According to the International Copper Association, demand for copper from the renewable energy sector is expected to grow by over 6% im Jahresvergleich 2024.

Rapid Growth of the Electric Vehicle Industry: Global sales of electric vehicles are projected to increase by approximately 20% In 2024, with an average electric vehicle requiring 80 kg of copper, significantly boosting copper demand.

Global Copper Mining Supply Chain Constraints

Major copper-producing countries, such as Chile and Peru, are facing restrictions due to environmental regulations and policies, causing copper production growth to lag behind demand. Data from the International Copper Study Group (ICSG) indicates a 1% supply shortfall in 2024, further driving up copper prices.

Rising Production Costs: The cost of copper mining and refining has increased by about 10% In 2024, especially in South America, where rising extraction costs exert strong support on copper prices.

Global Economic Recovery and Industrial Demand

The global economic recovery in 2024, particularly in infrastructure investments in China and India, has provided a substantial boost to copper demand. The manufacturing sector in China is expected to grow by approximately 4% In 2024, further supporting copper prices at elevated levels.

Investor Sentiment and Financial Market Volatility

Amid global economic uncertainty, copper has attracted considerable investment as a safe-haven asset. Data from the London Metal Exchange (LME) indicates a 15% year-on-year increase in copper trading volume in 2024. Heightened investor sentiment has contributed to price fluctuations and increases.

Copper Price Forecast for 2025

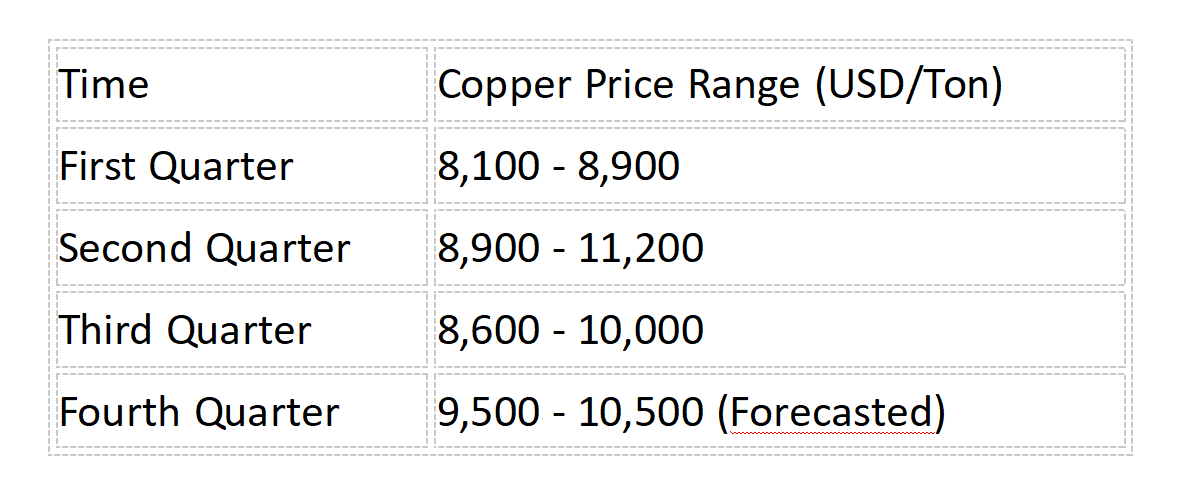

Based on the trends and driving factors observed in 2024, copper prices are expected to remain elevated in 2025. Given the sustained demand from renewable energy and electric vehicles, ongoing supply chain constraints, and geopolitical uncertainties, it is projected that copper prices may fluctuate between $9,200 und $11,800 per ton in 2025. Below is a detailed quarterly forecast for copper prices based on 2024 data:

Quarterly Forecast for 2025

First Quarter (Q1): The projected copper price range is between $9,200 und $10,200 per ton, as demand rebounds and supply remains tight, driving prices higher.

Second Quarter (Q2): With further demand driven by the renewable energy market, copper prices are expected to reach a peak of $10,200 zu $11,500 per ton.

Third Quarter (Q3): Traditionally a peak demand season for copper, prices are projected to fluctuate between $9,800 und $11,000 per ton.

Fourth Quarter (Q4): Due to the seasonal decline in demand towards year-end, prices are expected to range from $10,500 zu $11,800 per ton.

This pricing forecast is based on known data and industry trends, providing a reference for professionals in the copper market for decision-making in 2025.

Forecast Driving Factors Analysis

Sustained Demand for Green Energy and Electric Vehicles

The global green energy transition will continue to advance. Electric vehicle sales are expected to grow by 15%-20% In 2025. Zusätzlich, demand from the renewable energy market is anticipated to further increase, sustaining the upward trend in copper demand.

Persistent Copper Supply Shortages

The expansion of copper production in major producing countries such as Chile and Peru is hindered, and supply chain pressures are unlikely to ease quickly. The ongoing tight supply situation will continue to support higher copper prices.

Geopolitical and Trade Policy Uncertainties

Changes in the geopolitical landscape and trade policies in 2025 could impact the copper market. Import tariffs and supply chain fluctuations resulting from policy shifts in major consuming countries will significantly affect copper prices.

Global Economic and Industrial Growth

Increased demand from emerging markets such as China and India in 2025 will be driven by infrastructure project recoveries, further supporting copper price increases.

Speculative and Safe-Haven Demand in Financial Markets

Given the persistent economic uncertainties in 2025, copper will continue to attract attention as a safe-haven asset, potentially driving price fluctuations.

Operational Recommendations for Industry Professionals

Inventory Management and Risk Mitigation

Companies are advised to strategically plan their copper inventory levels and lock in prices in advance to avoid cost pressures from price increases. They should closely monitor geopolitical factors and trade policies that could impact copper prices and establish risk response measures.

Align with Trends in the Renewable Energy Market

Businesses with demand for copper products should further focus on the changes in demand within the renewable energy sector, especially in electric vehicles and grid expansion, and develop market strategies in line with copper price trends.

Hedging Operations in the Futures Market

The copper futures market offers tools for hedging price risks. Given the expected high volatility in copper prices in 2025, locking in prices through futures contracts can help businesses control costs.

Exploration of Material Substitutes and Technological Innovations

Some manufacturers may explore alternative materials such as aluminum and integrate technological innovations to optimize production processes, thereby reducing dependence on copper and mitigating the pressures of rising prices.

Abschluss

Gesamt, copper prices in 2024 are expected to maintain a high range between $9,000 und $10,500, primarily influenced by global green energy demand, supply chain constraints, and financial market factors. It is anticipated that copper prices will continue to operate at elevated levels in 2025, with a potential range of $9,500 zu $11,000. Industry professionals should focus on inventory management, stay attuned to renewable energy market demands, utilize futures markets for risk hedging, and consider material substitution strategies to achieve a more strategic and forward-looking market response.

By implementing the above strategies, industry professionals in the copper sector can better adapt to market trends and seize opportunities presented by future price fluctuations.